HAPPY NEW YEAR

At this time of year, we would like to wish all Seychellois people local and overseas, our faithful writers and bloggers, contributors, cartoonists, friends and family members a happy, prosperous and successful New Year.

We know that 2010 will not be easy, but do remember that each day that goes by, we get closer to our destination. Freedom from all the evils of SPPF-Lepep is close at hand. Let us believe in ourselves, in our rights as a people, and let us continue to write and share with others who have yet to see the light.

Together, we will prevail and rediscover our great nation called S-E-Y-C-H-E-L-L-E-S.

Our best wishes to all. Keep the faith and keep the torch of freedom burning.

The STAR Team

Thursday, December 31, 2009

Friday, December 25, 2009

The Seychelles Column - By Christopher Gill

The Year 2009 is quickly coming to an end. As we celebrate the birth of Jesus this December and we reflect on the successes of the year, the sorrows and perhaps our pitfalls, we must remember that Seychelles

Collapse of 2008 Confirmed in 2009

In the early days when I picked up my pen and wrote about the economy and social ills under then SPPF, now P.P. (Parti Le Pep), I was attacked for what I would say. I have been called every name in the book.

I was attacked when I said the Lehman Brothers Bonds were not a sustainable manner to generate cash for Seychelles Seychelles

Since October 31, 2008, the SPPF has changed its name, IMF has entered the picture with a second three (3) year plan that has been signed. Now we have over $69Million in additional debt burden through the IMF and World Bank in just one short year.

This Christmas, ask Mr. President, who signed for those BONDS? Then ask him, who will pay for those Bonds?

A Early Christmas Present For All Seychellois

Paul Mathieu has told us, what President James Michel did not tell us on October 31, 2008: Seychelles

Maybe it is because he was the Minister of Finance all that time, and perhaps he is the person who signed the Bonds in the first place. Or will James Michel tell us that Francis ChangLeng signed the Bonds. Or both of them?

Michel lacked the courage to tell us the truth of the failures of his Party to lead Seychelles

All you old SPUP’s, wake up this Christmas. Open your eyes to the failures of 15 people in your party that led Seychelles Seychelles , send IMF back to Washington and free Seychelles

Deflation or Depression in 2009

In 2009, Seychelles

IMF later adjusted the depression figures from -11% to -8% as a result primarily of the work Alain St. Ange did at STB as Marketing Director, in collaboration with the SHTA that together, came up with a discounting program for room prices in Seychelles to keep in step with world wide discounting.

Now the economy has only -10% arrivals, but -20% receivables. Unemployment was increasing, price of goods remained high, but did not increase by October. Hence, Governor of Central Bank Pierre Laporte said, Inflation was 0%. But that did not mean that goods were cheap. They were not of course. He meant that the Seychelles Rupee has gained incredible strength against the Euro, the most powerful currency in the world, under his leadership at the Central Bank. How does Mr. Laporte do that?

Give Laporte A Little Credit...But...

To his credit, Mr. Laporte stopped hyperinflation which was up to 78% last year, due to the variance of official rate to Black Market Rates and built up a reserve of $100 Million quickly by offering the highest interest rates in the world for Treasury Bills (32%).

This kept the government afloat as they mopped up Seychelles Rupees to keep Government in the cash flow. But because we were in a deflationary economic cycle and the Central Bank did not realize this while it strengthened the Seychelles Rupee against the Euro. At one point, the Euro was trading 1.0- 1.50 to a US Dollar, while it took a Pierre Laporte piano slide in Seychelles

Deflation Cycle Sets In

While Deflation was setting in Seychelles Seychelles

Deflation is a systematic economic cycle that reduces the size of a countries economy through less revenue, which curbs economic activity, reduces demand for hard currency, because people spend less simply because in real terms they have less to spend.

Protracted over a long period of time, it results in lack of demand for growth industries as construction, development, rentals, housing. Property values collapse. Only business that sell commodities required for living remain viable in a deflationary cycle. Pierre Laporte did not tell us this in 2009.

In the shops and warehouses, over extended Deflation, results in the warehouses being overstocked with goods, not because they can get all the foreign exchange to buy everything they want, but because, what they bought in a restocking effort, has not sold. Goods sit on the shelves, and expire, then the goods make their way to the dump site and they never make it to the Christmas table.

Dangers of Deflation

The Deflation cycle is particularly painful for any government to handle let alone its people. Prolonged over a long time, the unemployed lose their skills, fall to drugs, alcohol, and other social ills. This has a compounded effect on society. Programs must be set up to fine tune unemployed skills. Do not leave them to the road side P.P. They are not dead.

If Government ignore this facet of deflation, it results in not merely a collapsing economy, but a collapsing society. In Seychelles

Drugs and Alcohol

Government is hiding these statistics to fool us all, Seychellois, business community FDI players, you name it. All key partners have a mental barrier over these statistics when deliberating national issues. We must wake up, because the failure of Seychelles

Evidence of Collapsing Society

According to CARE, based on its research in schools with students, and a reasonable conclusion is drawn from the data collected, in Seychelles, we have a low figure of 9800 drug- alcohol addicts in Seychelles, and a high figure of 18,000 addicts in Seychelles. 18,000 is about 32% of our population. This is an alarming figure when we treat less then 50 people per year for the addictions.

This simple statistic is a warning to us all. In Seychelles

$100,000.00 Per Head Debt

Perhaps it is time to relook at the Seychelles USA

The policy of seeking out Arab friends in time of financial despair and in turn selling islands and Seychellois heritage for Scr.1.00 is a financial model of destruction.

Face Reality This Christmas P.P.

This Christmas SPPF, P.P. or whatever you will call yourselves next year, do get real. Come up with broad base solutions for Seychelles

Your AK-47’s and rocket launchers that gather dust now, will not be of much use to you this time.

Change your ways or you shall fail...again. This is my Christmas message to you!

A Message To The Opposition

At this time, I call on the Opposition in Seychelles Seychelles

To the NDP, I advise you, that in the effort to oppose, if you lack credibility in leadership, and have not established any depth of organization, then you will become irrelevant in the politics of Seychelles

To Mr. Boulle and his renewed efforts to form a new Party, I welcome your enthusiasm and energy, but you will have to establish a broad base of support, and you can do that by only being democratic in thought exchange of ideas, and pushing a real cause forward, and not necessarily a person.

To the team that just brought in a new 4 colour industrial printing press, to establish an independent press, Congratulations! May you hold true to the ideals of democracy, freedom of press, and justice for all Seychellois. You have done a great service to the future of Seychelles

To all in the Opposition, while the Christmas Season is upon us and the New Year comes, be forewarned that the challenges ahead must be tackled in unity, with the best ideas ruling the day, not the best man or best party. The problems of Seychelles

In the Kingdom of God

In the kingdom of man, knock until you break the door down. Dialogue, communicate, for it is we, who hold the key to set Seychelles

From my family, to yours, a very Merry Christmas and a Happy New Year!

May God Bless Seychelles

Christopher Gill

Saturday, December 19, 2009

Seychelles Cartoon - Merry Xmas from Barbarons Seychelles

Anyhow, I know that 2009 has been a difficult year for all of you and with Danny's new budget, let me assure you that 2010 will be even more difficult for all of you. But once again, I call on you to "Ser Sang" just a little bit longer and be a bit more patient. We will get through these difficult times together and believe me, Michel, Sarah and I really feel your pain and we will be standing by you all the way. Never think for a minute that we do not love our people. After all, you made us rich and we are very grateful to you all for keeping us in power for so long. So do you really think we can let you down now? Never, never, never!

Once again, our family wishes you all a very Merry Christmas and a prosperous 2010. Bonne Fete!

From Tonton Albert (the great Seychelles architect and leader for life), Sarah (wife number 3 or 4, I'm not too sure myself as Alzheimers is starting to set in), our busty nympha Ella (who has already sent some new sexy pictures of herself to everyone in Seychelles as a gift), and of course the rest of the family, maids, gardeners, cooks, drivers and soldiers at:

10 Cheap Acres

Barbarons Exclusive Estate

Mahe

Seychelles

Indian Ocean

P.S. We are also cutting back our budget in 2010 as times are really hard and we are doing our best to help the economy. We will only keep 50 soldiers at the property instead of 75 and also 12 personal bodyguards instead of 15. Poor Sarah has decided to sell 2 of her sports cars to buy new ones because tax has been reduced, so that's her way of contributing as well. After all, this is the least we could do for our country and our people.

Monday, December 14, 2009

Seychelles Presidential Awards and Literature

President James Michel of Seychelles has received more awards this year than Obama, Brown, Sarkozy and all other combined leaders of the world!

The only medals missing from his arsenal are the Pulitzer prize for literature and of course the Nobel Peace Prize. But hopefully in 2010 this one will be given to him for the bloody Coup D'etat of 1977 that killed several of his own countrymen and for becoming a Capitalist after preaching Communism for over 30 years!

The 1977 Coup D'etat Gang

And Mr. Michel is now doing a world tour (paid for by the poor Seychellois citizens who are under IMF management) as the greatest, eco-green President of all times, stating that Seychelles is sinking due to global warming and that the industrialized world owes Seychelles and other island states billions in aid to help Seychelles when she sinks.

Maybe that's why he built all those reclaimed islands so low into the ocean.... You see, France Albert Rene (FAR) and James Alix Michel (JAM) are the two greatest architects Seychelles has ever produced! Mr. Danny Faure current Minister of Finance will soon join that infamous list, especially with his recent budget speech that will drive businesses into bankruptcy faster than one can spell T-A-X.

The way I look at it, who needs money when you have already drowned? Seriously, have you seen any part of Mahe or Praslin sinking lately? And do remember that we have already sunked into bankruptcy already, courtesy of Mr. Michel's astute financial management skills as the Minister of Finance. Faure is also learning fast.

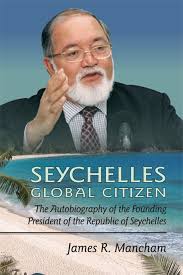

But hey, 2010 promises even more lies and maybe even more awards... this time for Stupidity and Denial. And as Michel releases his autobiography and tries to outsell the first President of Seychelles James Mancham's book titled Global Citizen, there will be a war of words so to speak.

Michel's book will probably be titled "The Seychelles Island Emperor With No Clothes" by James Michel.

Possible Book Cover for Michel's Autobiography

Of course, JAM is not to be confused with James Albert Michener the author of great books such as Hawaii, The Covenant, Mexico, Alaska and Tales of the South Pacific. Michener won the Pulitzer prize for fiction in 1948 and the Presidential Medal of Freedom in 1977. Well deserved awards may I add, and nothing like these fake trophies from Lebanon.

James Micheher

Mark Twain, another great author of famous books such as "The Adventures of Tom Sawyer" and "The Adventures of Huckleberry Finn" (which I hope Mr. Michel has read), once said:

"It is better to deserve honours and not have them than to have them and not to deserve them."

Mark Twain

Tuesday, December 8, 2009

Seychelles Chamber of Commerce - Comments on 2010 Budget Speech

Seychelles Chamber of Commerce & Industry

2nd Floor Ebrahim Building – P.O. Box 1399 VICTORIA – MAHE – SEYCHELLES

Tel: 323 812 Fax: 321422 E-mail: scci@Seychelles.net

PRESS COMMUNIQUE - Comments on the 2010 Annual Budget Speech

4th December 2009

The Seychelles Chamber of Commerce & Industry welcomes the ongoing economic reforms

and maintains that efforts must be sustained in a major restructuring of the economy to pave the way

for real growth of the productive sectors to provide job opportunities in the future. Real growth can only

be achieved through the net increase in the gross domestic product after any increase in prices has

been taken into consideration.

To this end, the SCCI welcomes the general principles of fundamental reforms being

introduced in the National Budget for 2010. However, the SCCI regrets that many of its proposals for

reform have not been considered or included in the provisions for the 2010 Budget and that the

fundamental issue of creating a level playing field in which all businesses within the economy will be

given equal and fair treatment is not sufficiently addressed in the Budget; a number of proposals as

mentioned below create more inequalities and the SCCI wishes to draw special attention to the

following:

1. Taxation Reforms

The SCCI welcomes the expressed intention of Government to carry out a major reform of the

taxation system based on ensuring a level playing field for all businesses and broadening the

taxation base to ensure more equality and a fairer distribution of the tax burden. However, the

SCCI is deeply concerned by the inequalities and unfairness that is maintained for too long a

period and by new inequalities introduced by the present reforms. To this end, the SCCI draws

attention to the following features of the budget which will likely hinder expansion to small

businesses

Business Tax - Reduced thresholds will affect the small businesses negatively. Whereas the

SCCI welcomes the reduction in top rates of taxation and notes that it will bring direct benefits only

to larger businesses, the proposal to tax all companies, which include small proprietary companies

(Pty Ltd) at higher initial tax rates compared to similar businesses operated as “sole traders”

brings in a taxation policy based on legal status and introduces unequal treatment for taxation

purposes within the same industry. The 15% withholding tax on interest will affect the savings of

small savers which is already exacerbated by a lower interest rate now down to 2% compared to

3.5% per annum prior to November 2008 and will have the effect of discouraging savings

altogether. Further the proposal to implement withholding taxes on all dividends paid will have the

negative effect of taxing the same “income” twice; a trend not in conformity with practices being

applied regionally e.g. Mauritius which has recently abolished all taxes on dividends. Furthermore,

the decision to exempt liability for social security contributions on staff accommodation, meals and

transport for the construction and tourism accommodation industries only should be extended to

all economic sectors in the interests of fairness and equality before the law.

GST – Pending the introduction of the VAT system, the proposed arrangement will benefit

businesses that import raw materials and the SCCI welcomes this. However, for the importation of

goods, the current practice of adding 12% GST to the 30% mark up effectively brings the GST

charged to 15.6%. It is therefore unlikely that there will be any major reduction in the costs of

imported goods. Furthermore, if services continue to be taxed on their turn over, the 15% GST

payable by the business (effectively 17.65%) is unlikely to reduce the cost of these services to the

consumers.

Trades Tax & Excise Duty – It is not clear whether the existing concessions and exemptions

granted under the Tourism Incentives Act and the Agriculture & Fisheries Incentives Act will

continue to apply and to what extent.

Personal Income Tax – Whereas the SCCI welcomes the general principle of widening the tax

base to have all citizens participate in the national economic effort, the SCCI is concerned of the

cost factor involved in the new system and expresses regret that once again an opportunity is

missed to level the playing field by allowing special rates for certain elements within the economy.

Moreover, the increase in gross salary of all workers will have a negative effect on the

compensation for long service which is already a serious financial burden and hindrance to

employment and which remains in force as long as the current Employment legislation subsists.

Furthermore, the PIT places the entire tax burden on the employer and will not assist in sensitizing

citizens on their individual responsibilities.

2. Cost of Doing Business

The SCCI also regrets the absence in the Budget speech of a firm commitment by Government to

address the high cost of doing business in Seychelles which has been exacerbated as a result of

the economic reforms of the past year and which will continue to be affected under the existing

budget proposals.

The SCCI regrets in particular the effect of the new personal income tax which will increase the

cost of employment and impact adversely on the element of compensation for long service which

will be calculated on a higher salary base as from July 2010 and the increase in the pension fund

contributions and the minimum wage.

Furthermore, without an effective reduction in the interest rate for borrowing and the forecast of

further increase in utilities, the cost of doing business is expected to increase further in the coming

year.

3. Review of the Business Environment to Enable Growth

The SCCI welcomes the announcement that Government is committed to undertake fundamental

reforms to modernise the business regulatory framework and improve the business climate.

However, the SCCI regrets that the delays in addressing these fundamental issues continues to

adversely affect businesses and creates additional burdens and negative factors to the rest of the

macro-economic programme in that the business climate is not conducive to further investment

and expansion of businesses and therefore is a hindrance to economic growth. Whereas the

groundwork in this process has been ongoing since 2004, very little progress has been made as

the economic situation has gone through fundamental changes.

The SCCI reiterates its full commitment to the review process of the Licensing Act, the Investment

Code, the Companies’ Act, the Employment Act and all other legislation that affects the business

environment and creates additional cost burdens to business.

The SCCI further regrets the opportunity lost in launching a national campaign for real productivity

gains and improvements in the National Budget at the same time as the reforms are introduced.

Conclusion

The SCCI recognises the work done to date in improving the economy and generally welcomes the

proposals for second generation reforms. Recognizing that the main objective in the national interest

is to create an enabling environment for real economic, the SCCI commits itself and the private sector

as a whole to continue working closely with Government as an equal and effective partner in the

national development of Seychelles.

2nd Floor Ebrahim Building – P.O. Box 1399 VICTORIA – MAHE – SEYCHELLES

Tel: 323 812 Fax: 321422 E-mail: scci@Seychelles.net

PRESS COMMUNIQUE - Comments on the 2010 Annual Budget Speech

4th December 2009

The Seychelles Chamber of Commerce & Industry welcomes the ongoing economic reforms

and maintains that efforts must be sustained in a major restructuring of the economy to pave the way

for real growth of the productive sectors to provide job opportunities in the future. Real growth can only

be achieved through the net increase in the gross domestic product after any increase in prices has

been taken into consideration.

To this end, the SCCI welcomes the general principles of fundamental reforms being

introduced in the National Budget for 2010. However, the SCCI regrets that many of its proposals for

reform have not been considered or included in the provisions for the 2010 Budget and that the

fundamental issue of creating a level playing field in which all businesses within the economy will be

given equal and fair treatment is not sufficiently addressed in the Budget; a number of proposals as

mentioned below create more inequalities and the SCCI wishes to draw special attention to the

following:

1. Taxation Reforms

The SCCI welcomes the expressed intention of Government to carry out a major reform of the

taxation system based on ensuring a level playing field for all businesses and broadening the

taxation base to ensure more equality and a fairer distribution of the tax burden. However, the

SCCI is deeply concerned by the inequalities and unfairness that is maintained for too long a

period and by new inequalities introduced by the present reforms. To this end, the SCCI draws

attention to the following features of the budget which will likely hinder expansion to small

businesses

Business Tax - Reduced thresholds will affect the small businesses negatively. Whereas the

SCCI welcomes the reduction in top rates of taxation and notes that it will bring direct benefits only

to larger businesses, the proposal to tax all companies, which include small proprietary companies

(Pty Ltd) at higher initial tax rates compared to similar businesses operated as “sole traders”

brings in a taxation policy based on legal status and introduces unequal treatment for taxation

purposes within the same industry. The 15% withholding tax on interest will affect the savings of

small savers which is already exacerbated by a lower interest rate now down to 2% compared to

3.5% per annum prior to November 2008 and will have the effect of discouraging savings

altogether. Further the proposal to implement withholding taxes on all dividends paid will have the

negative effect of taxing the same “income” twice; a trend not in conformity with practices being

applied regionally e.g. Mauritius which has recently abolished all taxes on dividends. Furthermore,

the decision to exempt liability for social security contributions on staff accommodation, meals and

transport for the construction and tourism accommodation industries only should be extended to

all economic sectors in the interests of fairness and equality before the law.

GST – Pending the introduction of the VAT system, the proposed arrangement will benefit

businesses that import raw materials and the SCCI welcomes this. However, for the importation of

goods, the current practice of adding 12% GST to the 30% mark up effectively brings the GST

charged to 15.6%. It is therefore unlikely that there will be any major reduction in the costs of

imported goods. Furthermore, if services continue to be taxed on their turn over, the 15% GST

payable by the business (effectively 17.65%) is unlikely to reduce the cost of these services to the

consumers.

Trades Tax & Excise Duty – It is not clear whether the existing concessions and exemptions

granted under the Tourism Incentives Act and the Agriculture & Fisheries Incentives Act will

continue to apply and to what extent.

Personal Income Tax – Whereas the SCCI welcomes the general principle of widening the tax

base to have all citizens participate in the national economic effort, the SCCI is concerned of the

cost factor involved in the new system and expresses regret that once again an opportunity is

missed to level the playing field by allowing special rates for certain elements within the economy.

Moreover, the increase in gross salary of all workers will have a negative effect on the

compensation for long service which is already a serious financial burden and hindrance to

employment and which remains in force as long as the current Employment legislation subsists.

Furthermore, the PIT places the entire tax burden on the employer and will not assist in sensitizing

citizens on their individual responsibilities.

2. Cost of Doing Business

The SCCI also regrets the absence in the Budget speech of a firm commitment by Government to

address the high cost of doing business in Seychelles which has been exacerbated as a result of

the economic reforms of the past year and which will continue to be affected under the existing

budget proposals.

The SCCI regrets in particular the effect of the new personal income tax which will increase the

cost of employment and impact adversely on the element of compensation for long service which

will be calculated on a higher salary base as from July 2010 and the increase in the pension fund

contributions and the minimum wage.

Furthermore, without an effective reduction in the interest rate for borrowing and the forecast of

further increase in utilities, the cost of doing business is expected to increase further in the coming

year.

3. Review of the Business Environment to Enable Growth

The SCCI welcomes the announcement that Government is committed to undertake fundamental

reforms to modernise the business regulatory framework and improve the business climate.

However, the SCCI regrets that the delays in addressing these fundamental issues continues to

adversely affect businesses and creates additional burdens and negative factors to the rest of the

macro-economic programme in that the business climate is not conducive to further investment

and expansion of businesses and therefore is a hindrance to economic growth. Whereas the

groundwork in this process has been ongoing since 2004, very little progress has been made as

the economic situation has gone through fundamental changes.

The SCCI reiterates its full commitment to the review process of the Licensing Act, the Investment

Code, the Companies’ Act, the Employment Act and all other legislation that affects the business

environment and creates additional cost burdens to business.

The SCCI further regrets the opportunity lost in launching a national campaign for real productivity

gains and improvements in the National Budget at the same time as the reforms are introduced.

Conclusion

The SCCI recognises the work done to date in improving the economy and generally welcomes the

proposals for second generation reforms. Recognizing that the main objective in the national interest

is to create an enabling environment for real economic, the SCCI commits itself and the private sector

as a whole to continue working closely with Government as an equal and effective partner in the

national development of Seychelles.

Seychelles Offers New Debt for the Bond Defaults

Read the article below very carefully. Note the new bonds will be due in 2026 and 2041 - Albert Rene and James Michel will be long gone by then. Christopher Gill is correct in saying that our children, grandchildren and great-grandchildren will pay for the folly-grandeur and of course the debts of Albert Rene, James Michel, Mukesh Valabhji, Francis Changleng, Glenny, David and Francis Savy, and all the other conniving thieves of the SPUP, SPPF and now Le Pep party.

*************************************************************************************************************

Seychelles Offers New Debt for $311 Million Defaults - Bloomberg Press

By Garth Theunissen

Dec. 7 (Bloomberg) -- Seychelles has offered holders of more than $311 million of its defaulted debt to exchange the instruments for new securities, according to a statement.

The Indian ocean archipelago off Africa’s east coast will offer a step-up bond due July 1, 2026, that will pay interest of between 3 percent and 8 percent over its duration, said Stuart Culverhouse, chief economist at Exotix Ltd., who cited a prospectus for the instruments. It will also offer a 2 percent fixed rate bond due July 1, 2041, he added.

“It’s got a bit of baggage but I’d imagine that the majority of creditors would sign up to the deal,” Culverhouse said in a phone interview from London. “The interest payments on these bonds are quite low and will be more in line with the government’s debt servicing capacity than the previous instruments.”

Seychelles missed payments on 54.75 million-euro ($81 million) of privately placed securities due 2011 in July 2008 as well as $230 million of 9.125 percent government bonds due 2011 in October of the same year as rising oil prices and falling tourism reduced government revenue. At the time, the default was the first by any sovereign nation since Belize in 2006, and prompted an emergency loan from the International Monetary Fund to help the nation meet spiraling debt-service costs.

The IMF bailout involved instituting a series of measures to reform the financial system, one of which was allowing the Seychellois rupee to trade as a free-floating currency. The Victoria-based Central Bank of Seychelles had previously pegged the rupee to a basket comprising the euro, dollar and pound, currencies in which it received the majority of its revenue from tourism and trade.

Rupee Decline

The rupee, which lost as much as 53 percent to more than 24 per euro following the decision to free float the currency from Nov. 3, 2008, has recovered 47 percent this year, Bloomberg data show. The currency gained 3.6 percent to 15.6788 today.

Seychelles will provide the bonds to holders “at the applicable exchange ratio,” according to a statement to the Regulatory News Service today. The new instruments will also be offered in exchange for “certain loans,” the statement added.

The 2026 bond will pay an interest rate of 3 percent from Jan. 1 next year, which will increase to 5 percent on Jan. 1, 2012, 7 percent on Jan. 1, 2015, and 8 percent in Jan. 1, 2018, where it will remain for the remainder of the bond’s duration, according to Culverhouse. Both bonds will be repaid in equal instalments, payable semi-annually, he added.

Seychelles, a former British colony, comprises about 115 islands scattered over more than 1 million square kilometers (386,102 square miles) and has a population of about 84,000.

Last Updated: December 7, 2009 11:08 EST

The Seychelles Column - By Christopher Gill

“The 2010- 4 Joker Budget” a la Danny Faure

Minister Danny Faure, Seychelles Minister of Finance, mustered all his courage that he learned to face the worse of times from his Cuba

In total the Budget Speech in front of me represents 52 pages, and the entire budget with the figures itself is nearly 150 pages. The strategy in that, is to wear down the Opposition, bore them to death, leave them in the clouds… “Cloud Nine (9)” if possible.

When the Opposition has made it to Cloud Nine (9), Faure will them hit them unassumingly with fake projections, that will instil confidence in the minds of the lay person. This will then, convert to continued support by the P.P. (aka Poor People).

Unfortunately, for Faure and P.P., in the next elections, people will vote with their empty stomachs, after Faure’s Budget speech delivers nothing on the table, and does not replace the worn out shoes for all those that are a little lucky now.

Like A Tall Hollow Tree Stands

While Faure’s voice bellowed out confidence, behind the numbers, behind the strategy, behind the acting that communists are famous for, there was nothing but hot air and internal rot, rivalling a budgetary joke of a Budget when faced with the dire straits Seychelles

People of Seychelles, SNP, NDP, and in particular, the SPPF families looking for a clear path forward, and all independent Seychellois as myself, this budget speech solidifies our suffering in brass and bronze. Mr. Faure as he has every year, will have you believe that it is a strong budget. It is not, as it has been every year. It is another nail in our economic coffin under P.P.. It is another Budget Speech of economic failures, because the economic fundamentals have been ignored.

1. More Promises of Success By Failures

As usual, it is a political budget that is meant to numb us into submission as a people and keep us on our knees as individuals. As Mr. Faure promises us a brighter future for our children, he neglects to tell us that it is our children and grandchildren who will inherit the debts created by his party, the same party that has nurtured him from cradles of infancy to Cuban education to office of Minister of Finance.

But then, correct me if I am wrong Minister Faure.

As you promise us a new, modern economy, you neglect to be candid with us to inform us, as we walk this new path of modernity, that we will carry the burdens of the One Party State debts and other debts created by your Government for roads that are full of potholes, of houses that are deteriorating, generators that do not work, and for failed, collapsed projects and ventures, for the next 25 years at least. Mr. Afif your good friend spins a positive note to the debts and says 18 years.

If so, I urge you to correct me if I am wrong Minister.

It is a budget that is intended to have us think that we should be grateful to be on our knees today; it is a budget that will ask us to be thankful for less, and be happy with less, but be happy at the same time, with SPPF, now P.P. failure. It is a Budget Speech that asks us to be grateful and pay homage to the missing US$ 2.4 Billion from our banking system as we undergo great suffering. Mr. Faure, by neglecting to address this issue, is asking us to forget about this missing money. Kiss it goodbye.

People of Seychelles

The second key is debt forgiveness, which Mr. Faure does not talk about. He speaks instead, about Debt restructuring, which will prolong the pain for us and our children. Mr. Faure does not speak about debt forgiveness because it will mean removing Mr. Faure and P.P. from Government to make it a reality. A sad state of affairs, but true.

2. Budget Performance

According to Mr. Faure, we have a Budget surplus of 5% in terms of projected performance. The highlight has been support and grants. This means: donations to keep us going. Mr. Faure strategy in 2009 has been to pull out the begging bowl and make the rounds for collections. Hardly an economic or budgetary strategy that you can rely on these days to foster real GDP improvements.

The begging bowl is not a pillar of the economy. How does it fit into GDP?

To his credit, the Revenue Authority has improved tax collections by 20%. But that does not mean there has been more money in the economy. It means they have been inefficient in collecting taxes in the past and that has resulted in hundreds of millions in loss revenue to the People of Seychelles which could have been used for roads, houses, hospitals, education. And even money to build our National Assembly and Judiciary buildings instead of relying on Chinese donations!

Most of this 20% surplus is from taxing income on rental homes and on interest. Houses have traditionally been a wealth savings for Seychellois. To now tax this base, unreasonably, P.P. Government is taxing our savings. Consequently, the housing inventory will be curtailed over the medium term as people are discouraged from building. The effect will be devastating on the construction industry, which is shrinking as we speak.

P.P. does not focus revenue collection where it should.

Example, the P.P. Government has been baby sitting Eden Island Development for years now. That is, on the revenue it receives, transactions on the houses the owners rent out as unlicensed holiday villas, the cars that are rented black market, and the boats that are chartered in the area. Most of the money is banked in some other area or other country.

Mr. Faure says SIBA and Nouvobanq returns have been high. Of course, they are higher than last year. It is in the “why” that Mr. Faure hides the reality. The reason “why” SIBA and Nouvobanq have higher Seychelles Rupee revenue is because of devaluation or floating of the Seychelles Rupee. No magic trick there.

Profits are high but money looks more like monopoly money in real terms than it did last year. First class Minister of Finance joke! Again, correct me if I am wrong Minister Faure.

3. Monetary and Financial Sector Developments in 2009

Mr. Faure says the primary objective of the monetary policy of P.P. is “price stability”. This is a fundamental objective of failure.

It is the Achilles heel of the failure of the P.P. monetary policy today. Again, they put the right shoe on the left foot, and put the left foot in their pockets and hop around on one foot without a shoe. A joke indeed, but our reality in any case. We must face it and take it down!

What Mr. Faure is saying is that P.P. through Pierre Laporte at the Central Bank, wants to use the powers of the Central Bank to curb inflation, keep it low, and make shopping in Seychelles

We do not live in a bubble of paradise. We are subjected to many external factors that affect the cost of goods hence inflation. Our governmental finances and misuse of funds and non-payment of debt will trigger inflation as well. Sooner or later, it will be back after the hocos-pocus of Pierre Laporte. Why? Because it never really left us, Pierre Laporte just hid it through buying up hard currency from the markets to keep us from discovering it. He cannot do that all the time.

Pierre Laporte’s job is regulating fiscal monetary policy in relation to supply and demand. Curbing inflation by using Central Bank monetary tools is like an old man using red Viagra pills to reclaim his youth prowess. When the pill wears off, the results could be cardiac arrest. The pill is wearing off now. Beware.

The better and most sound effort P.P. or any government could do in terms of “monetary policy” is not to ensure “price stability”, but rather, to ensure that we have “more money” (this means create growth conditions to increase GDP), to buy what we need and spend as we chose. This will create more economic activity, more money circulating which will reach everyone equally according to their sweat, ideas, sacrifice, ability to survive this catastrophic downturn we are entering, only now.

This is the better understanding of the Free Market P.P., not the garbage you are dishing out to us that is planted in ideas of greater failure than what we witnessed in the last days of One Party State

What you are doing with our finances today, is a little like putting Rene in a white safari suit, and calling him a great success, because he is the only one who dares wear such a silly looking, outdated dictatorial suit.

The Cost of P.P. Perverted Financial Policy

“Price stability” theory has a cost. The cost is an artificial Seychelles Rupee value that will not be acceptable by investors. As the value of the Seychelles Rupee falters to achieve legitimacy, there will be less hard currency in circulation, and the demand for that will increase.

Black Is Back

If Pierre Laporte is sleeping on the job, the Black Market will be back, as it is now, but it will become more prolific as it was two years ago. As that happens, Government, banks, business, will lose access to hard currency availability, Mr. Faure. You will be back to square one.

Enter Deflation Into P.P. Dreams

The additional cost of your “ Price Stability “ theory is DEFLATION to our detriment as a nation.

Mr. Faure may ask, what is DEFLATION? It is in simple terms: the reducing of size, in real terms of your economy. This means less money circulates, less activity, less growth, results in severe increases in unemployment, and if your labour force is not trained, or flexible, it results in the labour force becoming unemployable in the medium term.

Deflation has symptoms such as high profits when you devalue currency, or low inflation when no one buys anything, and no FDI when your one stop business centre is open, but the World Bank suggest that it better be a window instead of a door.

No Productive Capacity To Increase GDP- Face it!

Why will our labour force become unemployable, Mr. Faure will ask. Because if left unemployed for a prolonged period of time, they will lose their skills. Example, a carpenter is only as good as his last job. If he drinks for 3 years before his next job, he will not be as good as his last job.

Additionally, we have a severe problem with drug addicts that P.P. does not recognize and the budget treats the problem like it is a common cold. According to CARE, which I do work with as an anti-drug NGO, we have between 9,800-18,000 drug addicts in Seychelles

When these should be patients come for a job interview, we see the red eyes, we see the needle tracks on their arms and legs, we smell the drugs on them, we smell the alcohol. So they are not hired. These patients need to be treated before they can contribute to society Mr. Faure. To include them as part of Seychelles

This is why we have almost 10,000 workers on GOP and will continue to require them and more, unless we want to hand Seychelles over to Pirate Hassan for a holiday destination for hard working pirates, and lure them away from Kenya Somalia

As Mr. Faure seeks price stability, we undergo Deflation syndrome. Hence, our economy will shrink. We will have less and less money in circulation, goods can come down in price for a short time, but

Seychellois will not have money to buy them. Stores will be full, and warehouses stocked for a short time, then the goods will expire, rot, and merchants will raise the price of the next consignment to pay for the loss on the last consignment. The wheel of failure will turn, and it will spin for Mr. Faure into a state of hopelessness.

Correct me if I am Wrong Minister Faure.

4. Outlook for 2010

In this section of the Budget Speech, Mr. Faure takes his shoes, and throws them away, not having a grip on the outside world realities. Literally, the Minister of Finance has no clue what kind of deep economic recession the world is in 2009, 2010, 2011 and beyond. Without having a solid grip on what is happening in the outside world, little Seychelles

Mr. Faure fails before he even gets off from the starting line, because he does not know what race he is running. He shows up to a 15 kilometer race with a spoon and unboiled egg in hand.

Mr. Faure makes a reckless intellectual presumption that the global recovery is under way and results will translate into increase Tourism numbers in 2010 and increased FDI into Seychelles

If Europe ’s productive capacity is -15.75% this year, how will it recover in 2010? If the European banks are faltering under bad debts going unpaid, today in December 2009, how will it improve its situation in 2010 next month? Faure of course, in traditional communist style and fashion, puts the cart before the cow. You can forget about a horse with these guys.

It would all be funny if it was not our lives they are playing with. But they are playing with our lives and it is not funny for a moment.

The global recovery is at the beginning stages of recovery. The western countries, which we depend on for trade and tourism have lost enough money down the drains over night to bring their economies of 2008 back to YEAR 2000 in terms of the amount of money available in the markets.

That is 8 years Mr. Faure, not 8 days. USA Europe will not move upwards, if Wall Street does not. With -10.75 % unemployment in USA America , it is the workers that are the main investors in stocks, not the royal family as in Seychelles

Yes Mr. Faure, in America

In Cuba Raul owns most of the hotels and rent-a-cars with his ailing brother. Sound familiar?

Dreaming of Low Interest Rates

Wishfully, Mr. Faure asserts that bank interest rates will continue to drop. This is an “Alice

Without banks stimulating the economy through reasonable loan fees and in fact making money available to local business, there will be no investment in Seychelles

If banks cannot drop rates, and find that they are in a Pierre Laporte fish trap, then they are stuck.

If banks are stuck, then business is stuck.

If business is stuck, then the employed are stuck.

If the employed are stuck, it means the unemployed are out of luck under P.P..

This is the reality Mr. Faure does not address in his budget.

Our Reality Beyond Faure’s Fancy Words

Contrary to Mr. Faure’s assertion, in 2010, Seychelles Seychelles

Instead of increasing salaries by an insulting 4%, salaries of fat cats called constitutional appointments should have been cut by 38% since they have all collectively taken the money and simultaneously failed Seychelles

The question is not how much growth in 2010, but rather, how much less will the economy contract: -8%,-10%,-6%,-5%. This is not success or SIKSE as P.P. call it. It is FAILURE! Get use to the word.

Already in 2008 it was -4% and 2009 -8% according to IMF. Mr. Faure’s track record in running our national budget does not look good. He is getting worse every year. Based on the last 2 years performance, in 2010 he will bring Seychelles

Correct me if I am wrong Mr. Faure.

The mess the Central Bank made with the Treasury Bills has resulted in a greater loss of confidence in the Seychelles

While the Seychelles Rupee is in theory convertible, we have less money in circulation to use. Hence the real reason why banks had hard currency for a short period. A person who earned Rupee when it was 5.0 -1.0, could not afford to covert it at 10.0 – 1.0 or 13.0 -1.0 . It is a net loss. Hence the hard currency stayed with the banks, unless their was an emergency need for hard currency.

The commercial banks had so much hard currency, that it threatened the viability of the Seychelles

It is a little like an ICU patient.

You look at him and see him breathing.

You say, ah, looks like he is doing well.

No. He is not.

It is the machine forcing air to his lungs, and blood bottled connected to his veins keeping the flow.

This intervention keeps the patient alive.

Pull the machine, you kill the patient. The machine and blood bottle is a combination of IMF, World Bank, ADB, Central Bank tools, however badly they are used.

This is Seychelles

Mr. Faure can act like a success in front of the camera, but we who are on the ground, live, breathe, the failures of SPPF and today, P.P..

They are the same people less the 15% voters who dumped umbrellas in the bins around the country this year. Those that tossed the umbrellas know the impact of P.P. failed policies and attempt to stage act themselves out of economic malaise.

The rest of the budget is sectoral reviews of different departments and programs.

I leave that to the Public to rip apart as there are a lot of dreams and a lot of square pegs being put into round holes everywhere.

The end result will be a little like putting water in your fuel tank when your car runs on only unleaded fuel.

You can expect Mr. Faure to place a bold sign on your car that reads “HYDROGEN-DREAM CAR”.

Unfortunately, if your plan to make money is not thought out well, then your plan to spend it which can be as detailed as the amount of stars in the sky, will not work out well either, and will not be worth talking much about.

Dream on communist brothers, dream on.........

May God Bless All Freedom Loving Seychellois and Our Beloved Seychelles